Stablecoin Compliance and Orchestration Platform for Enterprise

Successful stablecoin operations demand integrated solutions across technology,

licensing, ecosystem expansion, and regulatory compliance.

Managing disparate solutions across blockchain node infrastructure, custody, exchange, and compliance tools creates operational complexity that delays launch timelines.

Evolving requirements including VASP registration, capital adequacy, 100% cash reserves, daily redemption reporting, and regulatory pre-approval demand comprehensive compliance infrastructure.

With the US Genius Act normalizing USD stablecoin issuance, Asian financial institutions must accelerate market entry to defend their competitive position.

Individual integrations with wallets, KYC providers, and liquidity partners create inefficiencies and escalating management costs.

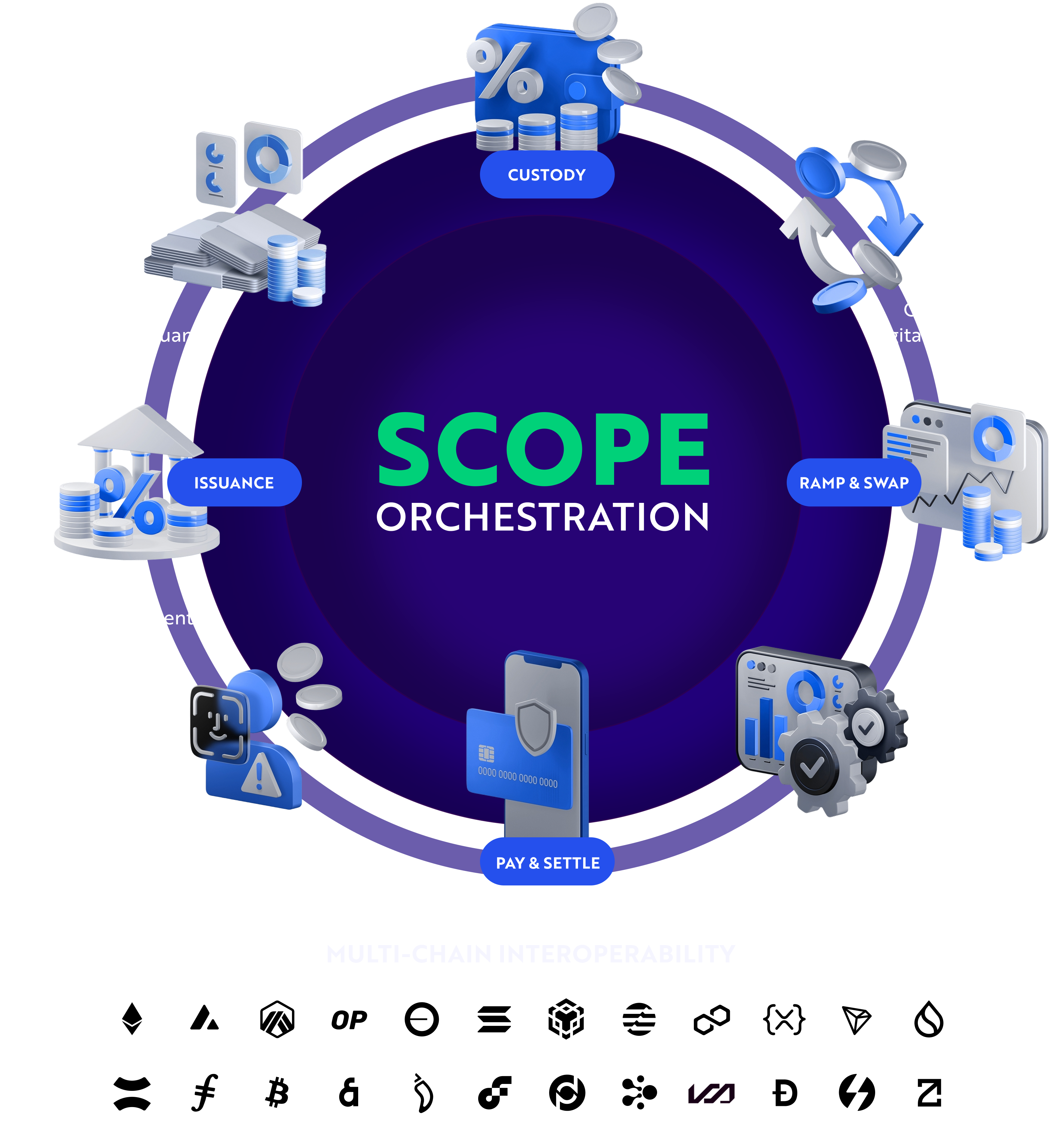

From issuance to payment settlement

unified stablecoin operations on a single platform

EVENT DRIVEN ORCHESTRATION

Event-Driven Automation for Complete Stablecoin Operations

Our Technical Partners

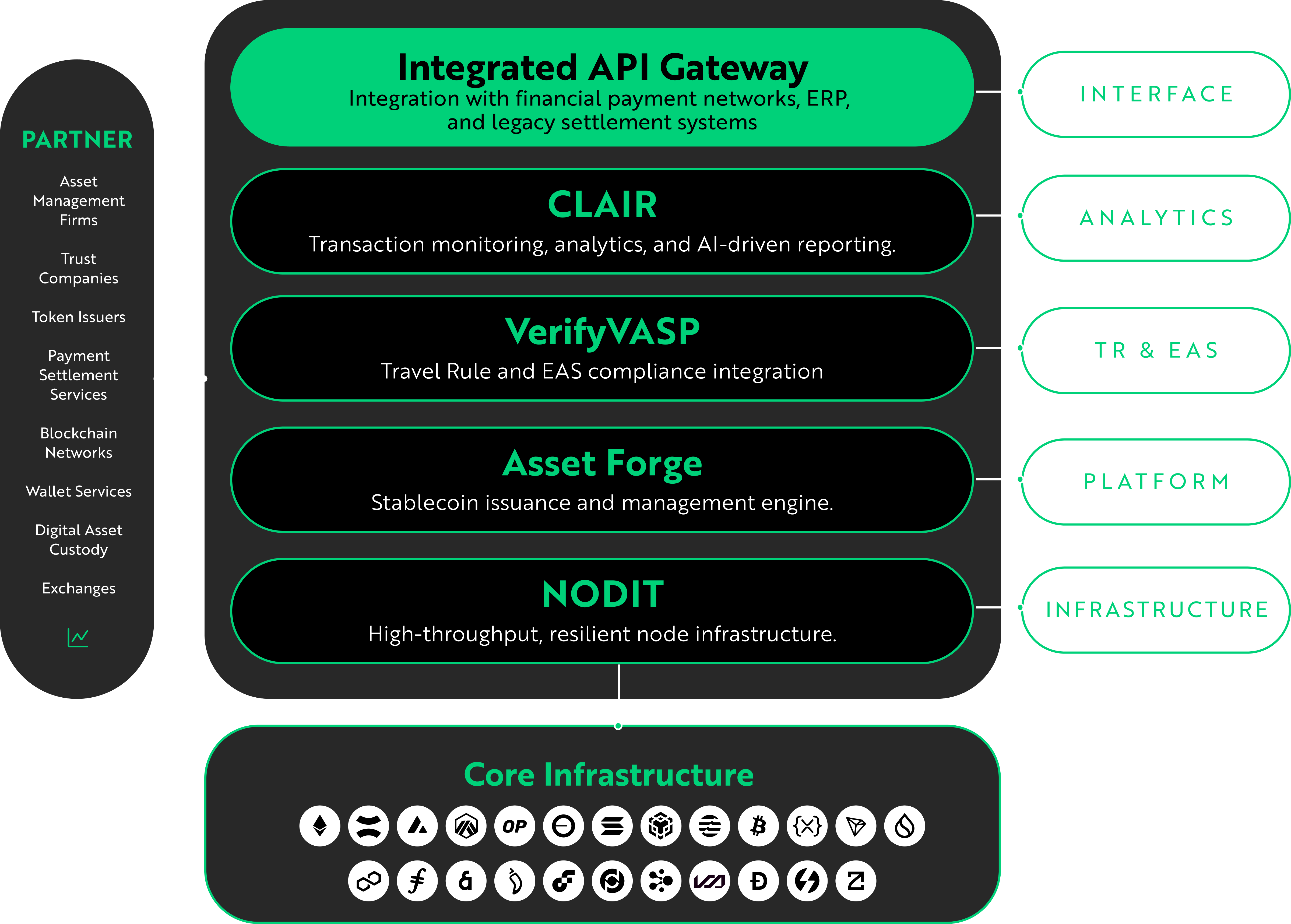

Build stablecoin-based payment and settlement infrastructure rapidly with our comprehensive technology stack designed for enterprise needs.

USE CASES

South Korea's only blockchain indexing data provider, delivering enterprise-grade SLA

guarantees to the nation's largest crypto exchange.

Tokenized Securities TEST-BED Project with Korea Securities Depository

Yuanta Securities

Blockchain Data Encryption Consulting

Fusionsense

UNIZ Academic System NFT Project

IM Bank

Incheon Technopark Blockchain Infrastructure Mainnet Supply

Finger

Token Securities Platform Business Requirement Consulting

INFC (F3P)

Blockchain Technology Consulting

Kyobo DTS

Lime Wallet NFT Project

IM Bank

Woori Bank WON Banking NFT Project

Woori Bank

Shinhan Investment Corp. STO Function Verification Project

Shinhan Investment Corp

KB Kookmin Bank Public Funds System Construction

KB Kookmin Bank

Momentica NFT Service & Mileage Integration Project

Levvels

Hyundai Department Store NFT Service & Marketplace Construction

Hyundai Department

Lotte Homeshopping NFT Service & Marketplace Construction

Lotte Homeshopping

Upbit NFT Service & Marketplace Construction

Dunamu

Milk Chain Consulting and Technical Support

Milk Partners

Hanwha Systems STO Functionality Verification Project

Hanwha Systems

Unlisted Stock Trading Platform Blockchain API Development

Dunamu

Blockchain Identity Verification Technology DID Joint Development

Yanolja

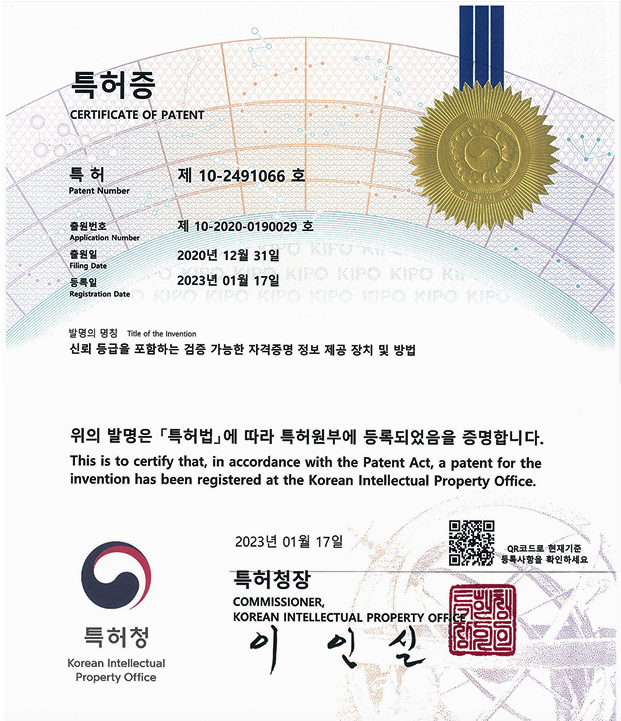

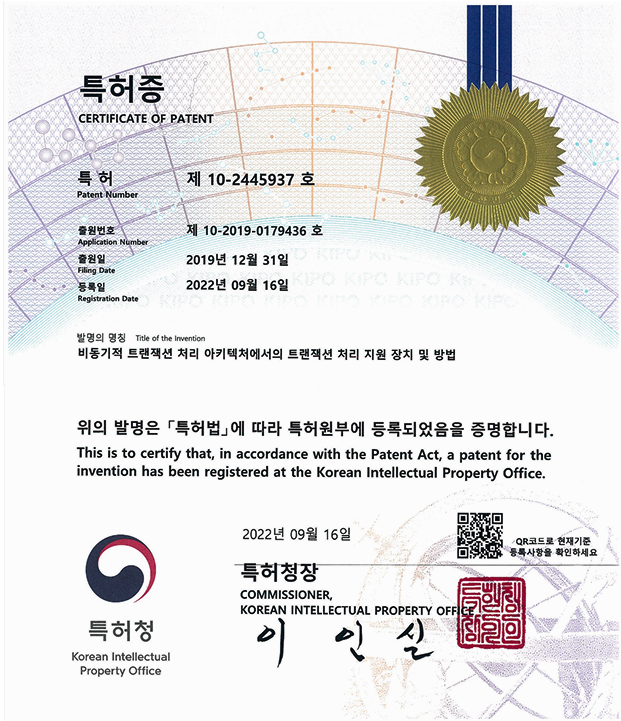

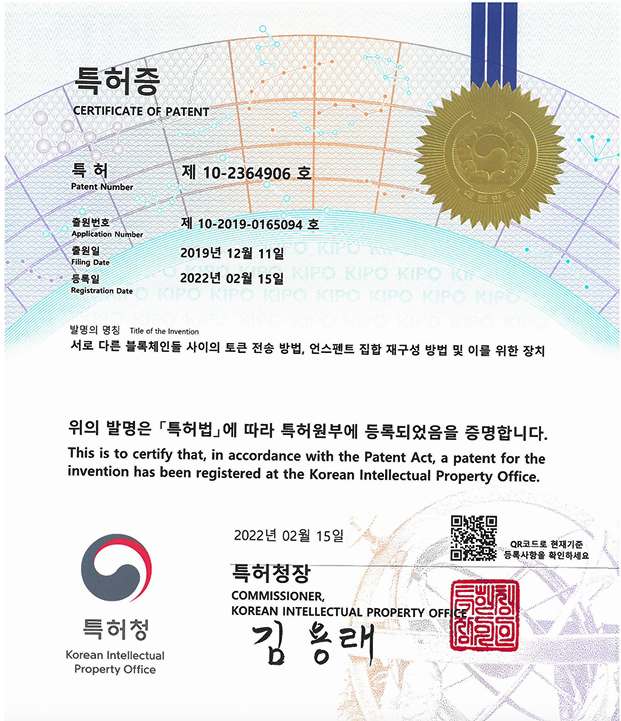

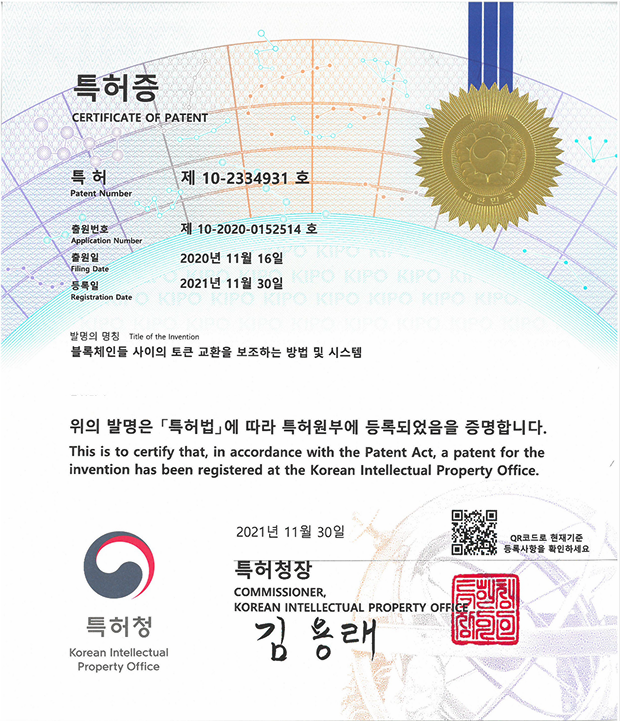

Technology Patents

Cross-chain token transfers / Cross-chain token swap mediation / Asynchronous transaction processing Blockchain-based anti-forgery systems / Virtual asset transmission mediation / Verifiable credentials with trust ratings DID-based product authentication / VASP wallet address identification / DID ownership management Deep learning-based fraud detection / Transaction management systems Heterogeneous graph neural network exchange wallet identification / Multi-chain EAS-based verification

Innovation-Driven Blockchain Finance Solutions

Proven infrastructure powering Korea's largest crypto exchange with enterprise-grade reliability

Complete support from major public chains like Ethereum and Polygon to consortium and private networks. Deploy dedicated EVM L2 chains rapidly for enhanced privacy and performance. Seamless REST API integration with existing core banking, brokerage, and payment systems.

Multi-signature and HSM dual protection minimizing key loss and theft risks. Multi-tier approval for all token operations with automated policy engine recording. Real-time audit logs and compliance reports streamlining regulatory and external audit processes.

Successfully delivered STO and trust projects with Yuanta Securities and Shinhan Investment Corp. Validated stability in regulated environments with institutional requirements fully integrated into product design. Complete satisfaction of institutional security, compliance, and performance standards.

Global regulations are evolving toward smart contract and real-time public audit frameworks. Perfect implementation of policy recommendations including trust-based reserve management and on-chain Proof-of-Reserves. Architecture designed for immediate compliance through configuration changes as regulations evolve.